“Impossible!” they say. “You can’t time the market.” “Just buy and hold.” “It’s time in the market—not timing the market—that’s important.”

We’ve heard these sayings many times. Market timing is supposed to be impossible. But this calls to mind another saying: “If you repeat a lie often enough, people will believe it.”

Defining our terms—what is market timing?

What is “market timing”? For us, it’s holding stocks when they’re moving up and moving to safety (the G or F Fund) when they’re not. This style is known as trend-following or momentum investing. This is the backbone of our system, though it also incorporates seasonality and other factors.

Once again, we use a system for this—not judgment calls or gut feel. Our system is data-driven and clearly answers the question “which fund(s) should you invest in?”

What market timing isn’t

No one can consistently call the market’s tops and bottoms. Therefore, we don’t make predictions. Nor do we make decisions based on news or world events.

Instead, we respond to what the TSP funds are already doing. Are they moving up, down or sideways? We measure this in a time-tested way and invest accordingly.

Buy and holders are right…partially

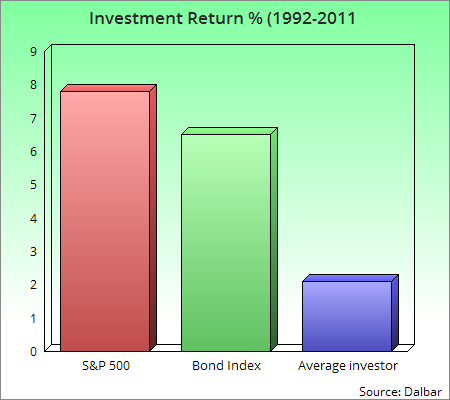

Most of us are naturally bad market timers. “Gut feel investing” rarely turns out well. So the buy-and-holders have a valid point. Studies show that most people are very poor timers.

Why do most investors do so poorly? Very few use a consistent, systematic approach. Instead, they buy stocks near market tops—after everyone else has bought. The dot com bubble is a classic example.

In addition, they usually don’t sell stocks until losses are devastating. Think about the 2002-2003 and 2008-2009 crashes. After selling, these investors are shell-shocked. It they buy stocks again, it’s near the top of another huge rally. And the cycle repeats.

The solution

So are the buy-and-holders right? No. The choice doesn’t have to be gut feel investing or buy-and-hold. Market timing systems offer another alternative.

Unlike people, systems don’t have emotions. They don’t panic. They don’t get greedy. They just analyze market data and suggest the best course of action.

Our system is proprietary and designed specifically for the TSP funds. We’ll talk more about in future articles. For now, let’s look at some other market-beating systems.

Example 1: Holy Grail

Advisor Theodore Wong tested his “Holy Grail” system on the S&P 500 from 1871 to 2012. This 142-year period is significant. Many buy-and-hold studies start after the 1940s, conveniently leaving out the Great Depression.

Wong’s system is very simple. He uses one indicator—a 6-month moving average. The result? It produced a 10.6% compound annual growth rate compared to 8.9% for buy-and-hold.

If you invested $1 in 1871, it would grow to $1.3 million. This is almost 8 times more than buy-and-hold, which grew to $164,000.

The “Holy Grail” reduced risk, too. Its standard deviation was one-third less than buy-and-hold’s. As we’ll see in our next blog post, avoiding the worst bear markets is crucial for your long-term results.

The 200 year test…and more

Capital Fund Management, a research firm, went even further. They tested their trend-following systems on stocks, currencies, commodities and bonds going back to 1800. Their conclusion:

We establish the existence of anomalous excess returns based on trend following strategies across four asset classes…and over very long time scales…We have found that the trend has been a very persistent feature…one of the most statistically significant anomalies in financial markets.

In plain English, trend-following beat buy-and-hold in a 200+ year test…in four different kinds of investments.

The authors of a recent book went further still. They did a similar test going back 800 years—with similar results. They also found that trend-following produced a superior performance.

Even a buy-and-holder admits…

Even Jeremy Siegel, a major advocate of buy-and-hold, gives market timing some credit. Siegel is a well-known author and Professor of Finance at the Wharton School.

In one of his books, he tested the popular 200-day moving average on the Dow Jones Industrial Average. His conclusion? This simple system improved risk-adjusted returns, even after considering taxes and commissions—things you don’t worry about in your TSP.

Trend-following’s relatives

Momentum investing, a close-cousin of trend-following, has a similar record of beating buy-and-hold. This is part of the approach we use. Eugene Fama, a Nobel-prize winning buy-and-holder, calls is it “the premier anomaly.”

The London Business School and AQR, a global investment firm, have tested momentum strategies for 80+ years. Both found that momentum strategies yielded superior returns.

A season for everything

When it comes to beating buy-and-hold, trend-following and momentum have the best track records. There are other successful approaches, however. One seasonal approach has outperformed buy-and-hold for over 300 years.

The verdict

Market timing can work—if you do it correctly. There’s strong evidence that trend-following and momentum strategies can increase returns and lower risk. Don’t listen to slogans about market timing. Look at the data instead.