When it comes to investing, do you follow the herd? Most TSP investors do.

Investopedia describes this herd instinct as a “lack of individual decision-making…causing people to think and act…as the majority of those around them.”

Popularity vs Performance

In our last two blog posts, here and here, we mentioned a recent TSP audit. It showed that TSP investors put 75% of their money into the C and G Funds.

This is clearly herd behavior. But is there a good reason for it? Do the C and G consistently outperform other TSP funds? No—not at all.

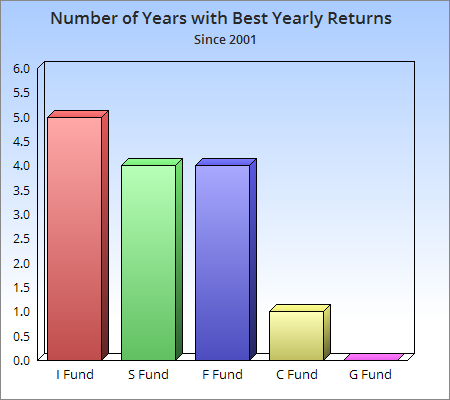

The chart below shows how many years each fund has had the highest annual return. It starts in 2001. We chose that year because that’s when the TSP added the I and S Funds.

Don’t follow the herd

The I, S and F Funds have clearly been the top performers since 2001. To its credit, the C Fund had the best return in 2014. However, this was its first “top performer award” since 1998. The G Fund hasn’t had the highest return since 1994.

Will this trend continue? No one knows. The point is that fund popularity has nothing to do with fund performance. If anything, you’d do better by going against the crowd.

And the least popular fund is…

The audit showed that the F Fund was the least popular. TSPers put ten times more money into the G Fund than into the F. Yet the F Fund outgained the G in 7 of the last 8 years.

Some people avoid the F Fund because interest rates are at historic lows. Interest rates and bond prices move in opposite directions. Therefore, it appears the F Fund has little room to move higher.

Instead of speculating on such things, it’s better to follow the trend. As long as the F Fund is moving up, it’s a logical choice when the stock funds (C,S, I) aren’t doing well.

The I Fund

The I Fund isn’t popular either. Some avoid it because it has unpredictable daily fluctuations.

This affects very short-term traders. If you hold the I Fund for a month or longer, it’s not a concern. The fluctuations cancel each other out.

So what should you do?

Does this mean we should only invest in the I, S and F Funds? Certainly not. But you shouldn’t avoid them, especially if their trends are stronger than the C and G Funds.

The moral of the story? Don’t follow the herd. Instead, follow the funds…the best-performing ones, that is.