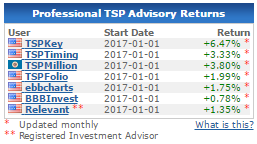

Before getting to the topic, here’s a brief look at our performance. Our return through the end of April was 6.47%. We remain well ahead of other services tracked by TSPCenter in 2017:

Retirement question

We sometimes get questions from people nearing retirement. They’re usually more risk-averse and wonder if our service is a good fit.

Here’s a typical question: “I’m 4 years from retirement. I currently have 70% in L2040, 20% in G and 10% in F Fund. Should I use TSPKey or stick with my allocation until I retire?” (Note: this isn’t an actual question, but we’ve received similar ones.)

Before addressing this, there are a few things to note. First, we can’t give personalized TSP advice. Second, every situation is different. There’s no one-size-fits-all answer.

Finally, we’ll assume you have a traditional TSP, not a Roth. With a traditional TSP, you can withdraw funds without penalty at age 59 1/2 while employed by the Federal Government or uniformed services.

Here are a few questions for those nearing retirement:

1) Do you need immediate access to your TSP funds when you retire or reach age 59 1/2? If not, how quickly will you withdraw your TSP funds?

2) Are you trying to protect your TSP principal from a market crash? If so, are you still willing to take some risk?

3) If you plan to transfer your TSP to another investment, have you compared the benefits?

Not all risks are the same

Our service is different than buy-and-hold investing. We sometimes have a 100% stock fund allocation, so it certainly isn’t risk-free. However, it’s not the same as permanently buying and holding stocks. We sometimes reduce our stock allocation for two reasons:

1) The stock market’s long-term trend turns negative

2) It’s a part of the year when stocks don’t perform as well historically

We do this to reduce risk. Backtesting shows it kept our losses much smaller than buy-and-hold in 2008. Because of these measures, we never remain 100% invested in stocks for an entire year.

You may not need to change your strategy

If you’d like to preserve your TSP as long as possible, you can take required minimum distributions (RMDs). You can wait until you’re age 70 1/2 before starting RMDs. According to this publication, your first RMD is about 3.65% of your account. When you reach 80, your RMD will be 5.35% of your account.

In normal market conditions, the stock market should outgrow RMDs–at least until your late 80s. The long-term annualized return of the S&P 500 is about 9%.

Of course, there may be down years. The market has bounced back quickly after most corrections, however

But I need to preserve my principal

Let’s say you want access to your TSP in a few years. You also want to preserve most of your account. Since no one knows when a bear market will show up, you want to reduce your exposure to stock funds.

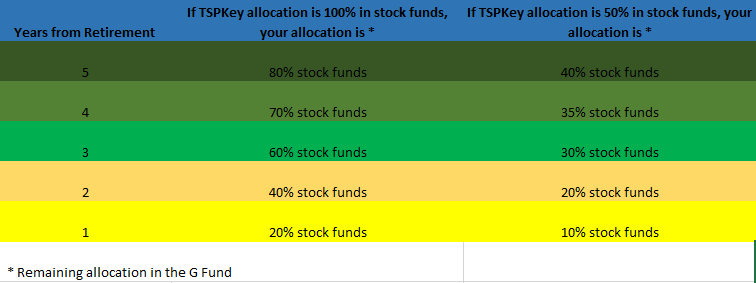

The chart below is a possible solution. Again, it’s not a customized plan for all investors. But it may give you some ideas. Note: TSPKey is always invested either 100%, 50% or 0% in stock funds (C, S and I). That’s why we covered the 100% and 50% scenarios in the table.

Bottom line

To answer the question we started with, those nearing retirement can definitely use our service. If you’re risk-averse, you can tailor our allocations to protect your principal