Tag Archives: TSP Funds

Newsletter 2/20/15

Newsletter 2/06/15

Should You Invest in the Most Popular TSP Funds?

When it comes to investing, do you follow the herd? Most TSP investors do.

Investopedia describes this herd instinct as a “lack of individual decision-making…causing people to think and act…as the majority of those around them.”

Popularity vs Performance

In our last two blog posts, here and here, we mentioned a recent TSP audit. It showed that TSP investors put 75% of their money into the C and G Funds.

This is clearly herd behavior. But is there a good reason for it? Do the C and G consistently outperform other TSP funds? No—not at all.

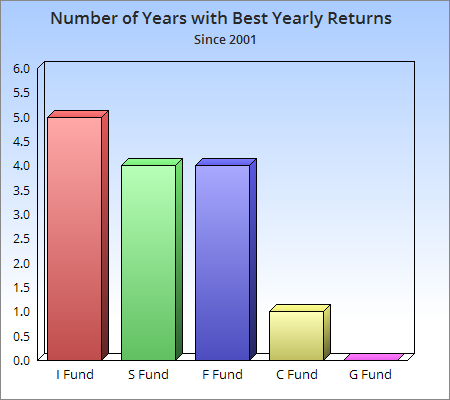

The chart below shows how many years each fund has had the highest annual return. It starts in 2001. We chose that year because that’s when the TSP added the I and S Funds.

Don’t follow the herd

The I, S and F Funds have clearly been the top performers since 2001. To its credit, the C Fund had the best return in 2014. However, this was its first “top performer award” since 1998. The G Fund hasn’t had the highest return since 1994.

Will this trend continue? No one knows. The point is that fund popularity has nothing to do with fund performance. If anything, you’d do better by going against the crowd.

And the least popular fund is…

The audit showed that the F Fund was the least popular. TSPers put ten times more money into the G Fund than into the F. Yet the F Fund outgained the G in 7 of the last 8 years.

Some people avoid the F Fund because interest rates are at historic lows. Interest rates and bond prices move in opposite directions. Therefore, it appears the F Fund has little room to move higher.

Instead of speculating on such things, it’s better to follow the trend. As long as the F Fund is moving up, it’s a logical choice when the stock funds (C,S, I) aren’t doing well.

The I Fund

The I Fund isn’t popular either. Some avoid it because it has unpredictable daily fluctuations.

This affects very short-term traders. If you hold the I Fund for a month or longer, it’s not a concern. The fluctuations cancel each other out.

So what should you do?

Does this mean we should only invest in the I, S and F Funds? Certainly not. But you shouldn’t avoid them, especially if their trends are stronger than the C and G Funds.

The moral of the story? Don’t follow the herd. Instead, follow the funds…the best-performing ones, that is.

Newsletter 1/30/15

Newsletter 1/2/15

Newsletter 12/26/14

Newsletter 12/19/14

Newsletter 12/13/14

To G or not to G

An investment that doesn’t lose money is attractive. This is especially true for conservative investors. And after two devastating bear markets within 10 years, many investors are more conservative. This is why the G Fund is so popular. There’s no risk of losing your money in it. Unfortunately, its popularity comes with a cost.

A cost? Wait, but the G Fund can’t lose money? We’ll get to that in a moment.

Most popular fund

As noted in our last article, the G Fund is the most popular TSP fund. An end-of-2013 audit found that nearly 45% of TSP assets were in the G. That’s more than twice the amount in the S and I Funds combined.

This would make sense in a stock market crash. But the end of 2013? After two straight years of the C, S and I Funds making double-digit gains?

What’s more, people in their 20s have higher G Fund allocations than those in their 50s. That’s according to Federal News Radio, quoting a memo from the TSP’s executive director.

Still, you may wonder “What’s wrong with this? The G’s return is pretty low, but there’s no real risk, right?” The problem is what economists call an opportunity cost. An opportunity cost is what you give up when you make a choice.

You can’t have it both ways

An example should make this clear. Say you budget $20 for dining out and entertainment on Saturday. You spend it on a movie and snacks in the afternoon. That evening, you get hungry and crave pizza. You wonder if you should’ve saved the $20 for dinner. What’s your opportunity cost? It’s the pizza you couldn’t buy for dinner. You gave up this “opportunity” when you splurged in the afternoon.

Let’s apply this to investments. Assume you have $10,000 in your TSP account and a 100% G Fund allocation. You consider using a more aggressive strategy. Instead, you stay fully invested in the G Fund.

Eight years later, you realize the aggressive strategy would’ve doubled your account. Your account balance could be $20,000. Instead, you only have $12,000. That’s an $8,000 difference, and it’s your opportunity cost. That’s a big price to pay to “conserve” your money.

Retirement plans aren’t emergency funds

Ultra-conservative investing is smart in some situations. If you have an emergency fund, don’t take big risks with it. A long-term retirement plan is different, though. It can compound and grow over decades. A large, permanent allocation in the G Fund has a tremendous opportunity cost.

Is the G Fund ever appropriate? Sure. During bear markets, the G and F Funds are the best places for your money. But when stocks are moving up, you want to follow the trend.

The G Fund is a valuable tool. You just need to know when to use it. If overused or employed at the wrong time, it can be very costly.